M&A Advisory and Business Broker Services

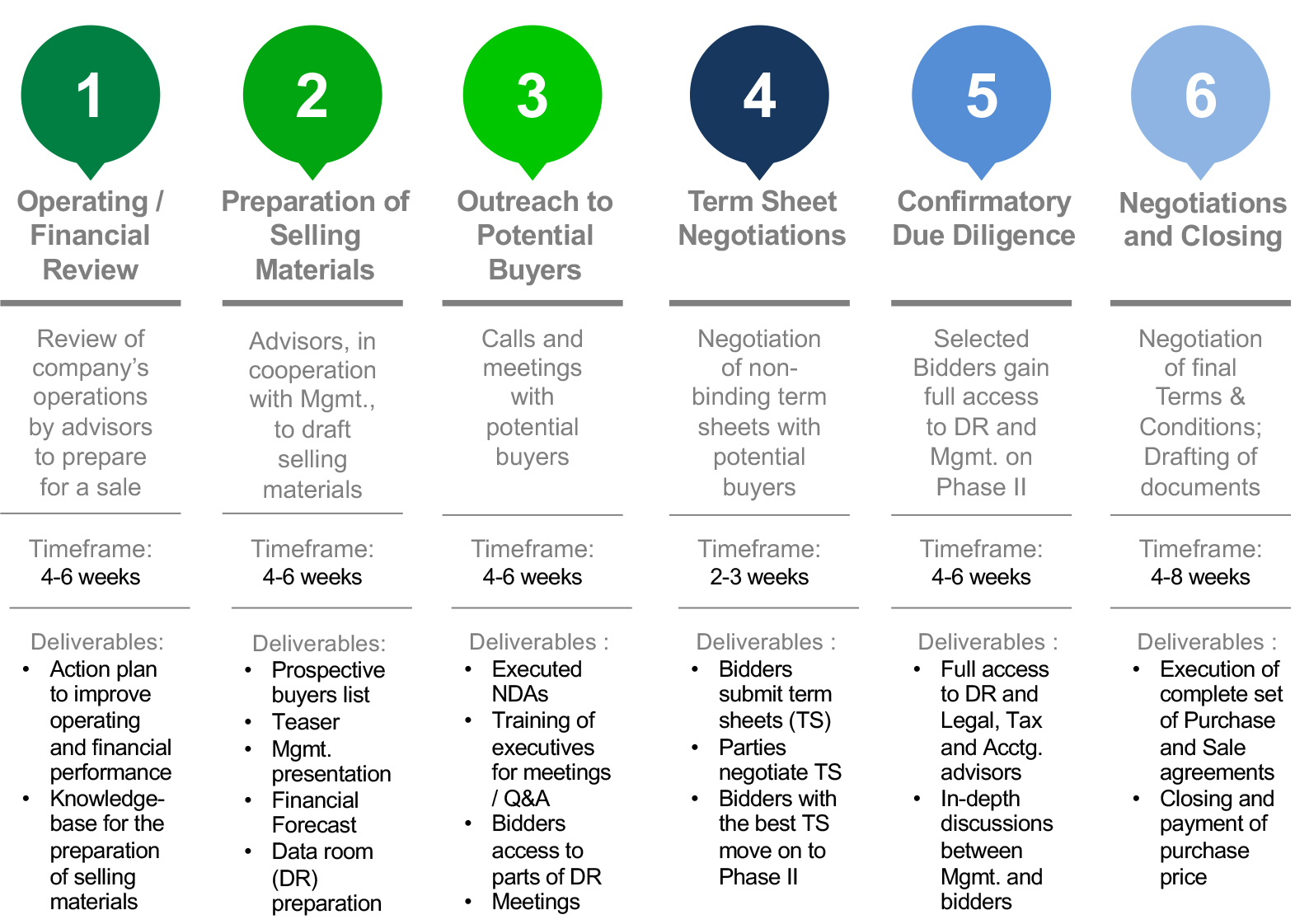

Selling your business is a complex, time-consuming endeavor. And oftentimes your counterparties are very experienced in structuring and negotiating these transactions. Level the playing field and maximize your outcome by having experienced advisors by your side.

Our team of seasoned M&A specialists has successfully closed $35+ billion worth of M&A transactions in numerous industries and countries, with deal sizes ranging from a few million to a few billion dollars. Leverage this experience, gained at large investment banks and corporations, to secure a better deal for your small business.

The team is led by Mario Wanderley, previously an investment banker with J.P. Morgan and CFO/COO of companies backed by major private equity and venture capital firms, including The Blackstone Group, the world’s largest private investment firm.