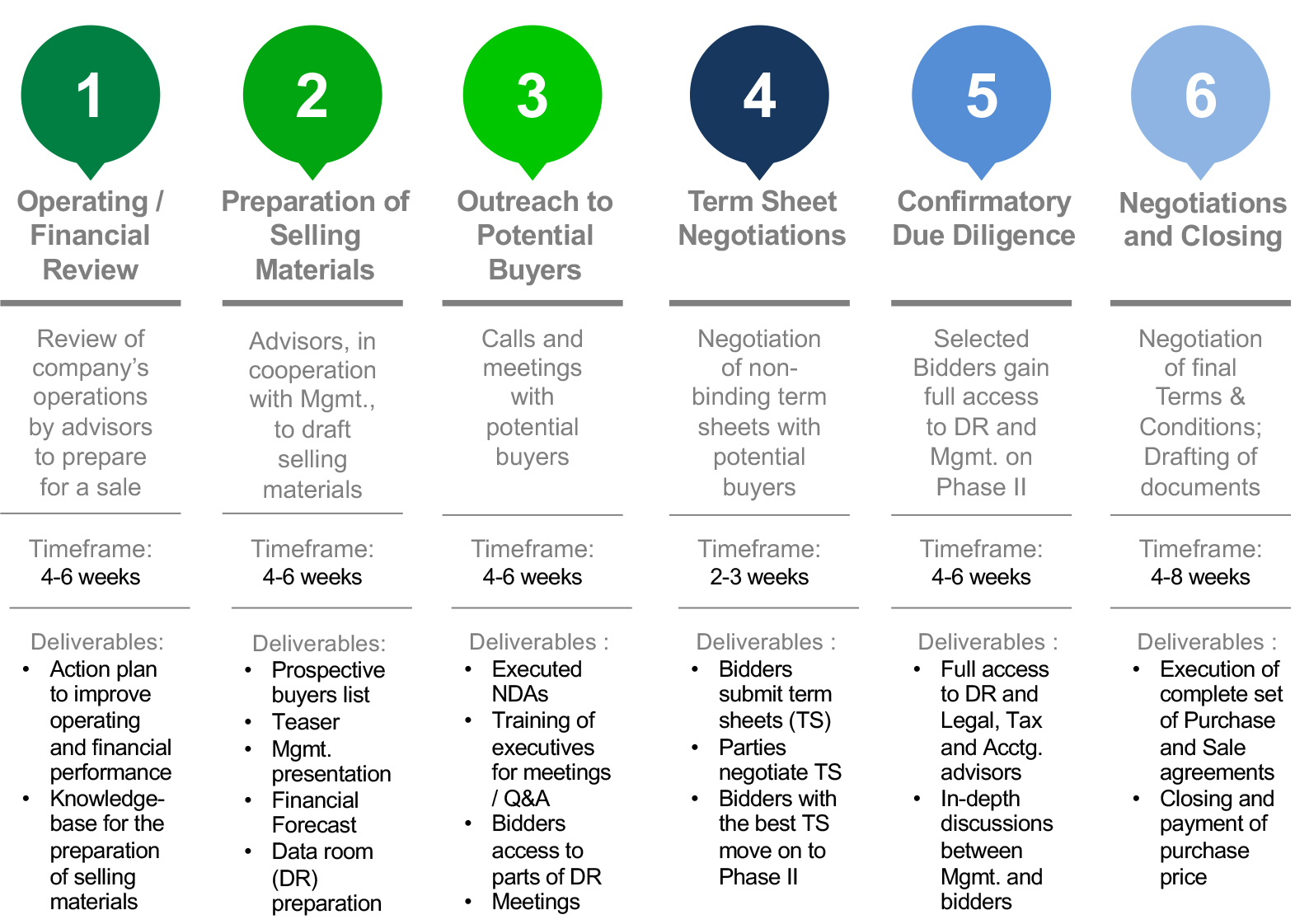

VGP’s Sell-Side M&A Transaction – Process Overview (Steps 1 and 2)

Operating / Financial Review

VGP and other advisors* to identify areas for operating and financial performance improvement, and preparation for the M&A process. To the extent possible, company to capitalize on opportunities and implement action plan right away, to show continued progress and the fulfillment of potential.

- Identify and capitalize on opportunities for revenue growth

- Review cost structure and implement cost-saving measures

- Assess and mitigate risks – including by buying additional insurance policies as needed

- Create option / bonus plan for key employees

- R&D tax credit study

- Quality of Earnings report

- Audit of financial statements

- Tax planning – for the company and its shareholders

Preparation of Selling Materials

VGP to prepare selling materials, with the support of management and other advisors.

- Agree on list of prospective buyers to reach out to

(strategic and financial buyers) - Company overview / Investor Teaser (2-3 pages word document or 5-6 pages slide deck)

- Management presentation

— 10-15 pages for Phase I

— 20-30 pages for Phase II - Five-year financial forecast, to include synergies’ analysis with potential strategic buyers

- Preliminary valuation, using Discounted Cash Flow and trading / transaction methods (for internal purposes)

- Presentation describing company’s current technology and roadmap

- Preparation of data room for legal, technical and accounting due diligence (preparation is often started at this stage but concluded at a later date)

* Items in italic to be performed by other advisors, in coordination with VGP

VGP’s Sell-Side M&A Transaction – Process Overview (Steps 3 and 4)

Outreach to Potential Buyers

VGP to reach out to select strategic and financial bidders:

- Socialize opportunity on a no-name basis

- Share company overview / teaser with interested parties

- Negotiate and execute Non-Disclosure Agreements

- Share management presentation

- Prepare management for discussions with potential bidders

- Coordinate and oversee meetings between management and potential bidders

- Oversee continued preparation of data room (portions of which to be performed by company and other advisors)

- Coordinate bidders access to certain information contained in data room

Term Sheet Negotiations

VGP to lead term sheet negotiations and assist on the selection of best offers

- Prospective bidders submit detailed, non-binding term sheets

- Parties negotiate terms and conditions, being mindful of deal structure’s impact on tax planning objectives

- VGP to provide comparison and analysis of different offers

- VGP to advise on the selection of 2-3 bidders to move on to the next phase (it is possible that the strongest bidder will insist on exclusivity for a period of time – say 30-45 days; which depending on how detailed the term sheet is and how favorable the terms are, we may advise in favor of – although our preference is always to have two bidders during Phase II)

* Items in italic to be performed by other advisors, in coordination with VGP

VGP’s Sell-Side M&A Transaction – Process Overview (Steps 5 and 6)

Confirmatory Due Diligence

During this phase, bidders gain full access to the data room, the management team and its advisors. VGP to:

- Oversee data room access

- Compile potential buyers’ questions

- Advise on the best way to answer questions and address areas of concern identified by bidders

- Train and prepare management team for in-depth interviews / meetings with potential buyers. Topics of discussion typically include:

— Company’s business, growth strategy and prospects

— Financial forecast

— Technology demo and product roadmap

— Legal and accounting matters - Coordinate interaction between company’s advisors and bidders’ advisors

Negotiations and Closing

While the term sheet will have covered a number of important terms and conditions, the negotiation and drafting of final deal documents is intense and time consuming. Often, potential bidders will seek to renegotiate T&Cs agreed at the term sheet level due to findings during Confirmatory Due Diligence. VGP’s activities during this phase, include:

- Negotiating final terms and conditions, including, when applicable: (i) earn-outs; (ii) non-competes; (iii) employment agreements for owners; (iv) reps and warranties (and advise on the possible purchase of R&W insurance), etc.

- Minimizing or averting any valuation reduction due to DD findings

- Overseeing the drafting of Sale and Purchase agreement and other transaction documents