It’s that time of the year – for companies to ‘close their books,’ an accounting procedure that ensures financial information is accurate and comprehensive for a given period.

Closing the books must be done in advance of filing the company’s income tax return and preparing annual financial statements – documents that are essential for reporting the company’s performance, complying with tax laws, securing financing, preparing for due diligence for a potential sale, and most importantly, planning for the future.

Some companies choose to close their books at the end of each month or quarter, depending on their business needs and preferences. This can help monitor cash flow, track progress, make timely adjustments, and make the year-end close easier and more efficient.

Many steps are required to close the books and issue financial statements – and this article provides an overview and checklist of the most common closing activities:

CLOSING CHECKLIST

- Verify all billable time is included in timekeeping system.

- Issue invoices to customers for all services provided and goods shipped though month-end.

- Reconcile invoices to shipping logs.

- Issue recurring invoices to customers.

- Verify that all subcontractor invoices were received and included in customer billings.

- For project job costing clients, like construction companies: Prepare AIA billing based on scheduled values in contract and percentage of completion.

Accounts Payable

- Enter all vendor and supplier invoices in the systems by the designated cutoff to match income and expense according to GAAP (generally accepted accounting principles).

- Enter all employee expense reports.

- Accrue for all material expenses for which the vendor or supplier invoice has not been received.

Fixed Assets

- Verify fixed asset additions and deletions are correctly reflected.

- Record depreciation and amortization expenses.

- Record the impairment of applicable fixed assets.

Inventory

- Verify there was a proper inventory cut-off.

- Count the inventory or run a perpetual inventory report.

- Determine cost of ending inventory.

- Adjust the ending inventory valuation for the lower of cost or market rule.

Journal Entries

- Allowance for doubtful accounts.

- Accrue:

- Revenue

- Supplier billings

- Vacations

- Wages

- Bonus expense

- Commission expense

- Accrue interest expense for any loans

- Depreciation and amortization

- Income tax liability

- Reserve for:

- Obsolete inventory

- Sales returns

- Warranty claims

Balance Sheet Reconciliations

- Bank reconciliations: Access bank’s online account records and reconcile all cash and credit card accounts.

- Accounts receivable (trade): Match the total in the ending aged accounts receivable report to related general ledger account.

- Prepaid expenses: Review this general ledger account to see if any items should be charged to expense.

- Inventory: Match the total in the extended ending inventory report to the related general ledger account.

- Work in Process: The WIP report identifies whether active jobs are over-or-under billed, compared to the percentage completion for each job. Based on this report, an adjustment should be made to costs in excess of billings or billings in excess of costs.

- Intercompany Balances: Verify intercompany balances tie in with each other.

- Accrued liabilities: Review each accrued liability account in the general ledger and verify that it matches supporting detail.

- Notes Payable: The balance in this general ledger account should match the account balance provided by the lender.

- Equity: Verify that equity accounts match the supporting detail.

Consolidate Results

- Eliminate intercompany transactions.

- Convert currencies.

Year-end closing summary

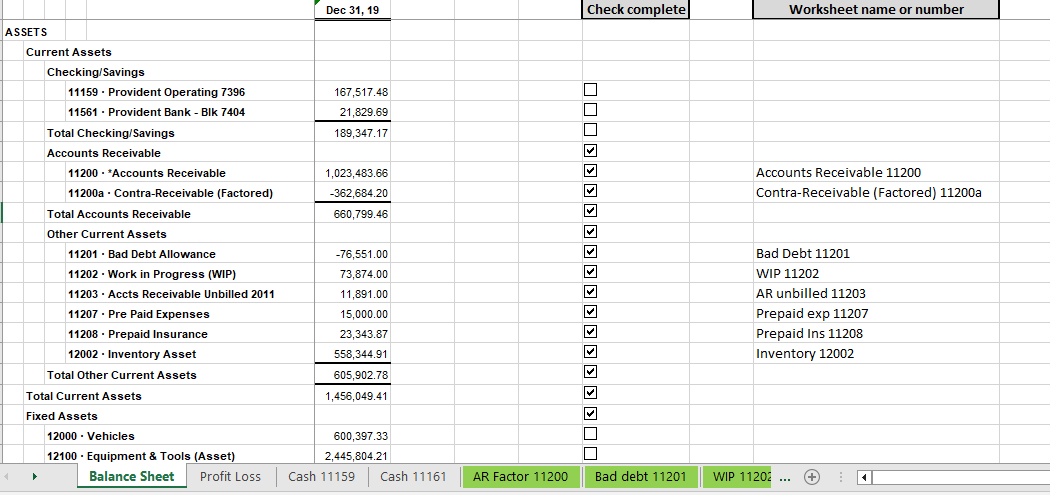

It is critical to have your closing financial statements and related reconciliations documented in one place – to support your closing of your books, and as a basis to start your books for the following year. As reference, a sample Excel report:

While closing your books can be a complex process, creating this spreadsheet will help streamline the procedure.

Let’s discuss more about closing the books in a complimentary consultation!

Article written by our team member Ed Scordato, CPA, Certified QuickBooks Advisor

To learn more about how Venture Growth Partners can help you turbocharge your business through our fractional CFO and COO services and our capital raise and M&A advisory services, please schedule a free consultation by filling out the form below.